ABSORPTION RATE ANALYSIS

ABSORPTION RATE ANALYSIS

Recently in a class, I asked how many of my real estate students were using Absorption Rate Analysis? When less than 30% of the class answered yes, I was amazed. Giving this analysis to potential sellers is one of the finest tools for listing at a salable price that I’ve ever experienced. Here is how it works:

Absorption Rate Analysis – Resale Application

How many homes are absorbed by the market on a monthly basis?

Example of application:

Your Right Price Analysis on a seller’s home determines a Price Point of $539,000.

The sellers inform you that they want to list their property with you for $589,999.

To explain the effect of current market activity and validate the Price Point derived from your RPA, you create an Absorption Rate (AR) Analysis as follows:

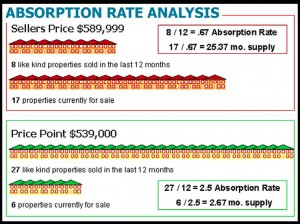

First, determine the number of like-kind homes that have sold in the last 12-months at their expected price of $589,999.

8 Properties sold and closed in the last 12 months

Second, divide this number by 12 to determine the number of properties absorbed by the market on a monthly basis.

8 / 12 = .67 absorption rate

Third, you search the numbers of like-kind homes that are currently on the market (for sale) at their expected price of $589,999.

17 Properties are currently on the market

Fourth, divide this number by the absorption rate to determine how many months it will take to absorb what is currently for sale at their expected price of $589,999.

17 / .67(AR) = 25.37 month supply

Fifth, determine the number of like-kind homes that have sold in the last 12-months at your RPA Price Point of $539,000.

27 Properties sold and closed in the last 12 months

Sixth, divide this number by 12 to determine the number of properties absorbed by the market on a monthly basis.

27 / 12 = 2.25 absorption rate

Seventh, you search the numbers of like-kind homes that are currently on the market (for sale) at your RPA Price Point of $539,000.

6 Properties are currently on the market

Eighth, divide this number by the absorption rate to determine how many months it will take to absorb what is currently for sale at your RPA Price Point of $539,000.

6 / 2.25(AR) = 2.67 month supply VISUAL

What I say to the sellers, please choose your own words:

Mary, John, your goal is my goal. Get the highest price in the shortest amount of time with the least inconvenience to all.

As we have discussed, my Right Price Analysis (CMA in some brokers words) determined that the current Price Point (never use price as it too personal, use price point) on your property is $539,000. Further analysis of the market shows us that at this Price Point there is a 2.67 month supply currently for sale. This means that if no other properties come on the market, these properties should be absorbed, or sold, in the next 2.67 months placing your home in position for a faster sale.

However, if you push the list price to $589,999 price, the analysis shows us there is a 25.37 month supply meaning your home is likely to sit on the market for over 2 years before it sells.

However, if you push the list price to $589,999 price, the analysis shows us there is a 25.37 month supply meaning your home is likely to sit on the market for over 2 years before it sells.

Based on this information, and your timeline, how do you want to position your property?

Mary says, “We choose the higher price. Bring us an offer and we’ll come down.”

I say (remember my words, choose your own), “Fine, I’ll take a 25 month listing and there will be no sign or marketing for the first 22 months.”

Absorption Rate Analysis is a tool that will set you apart from the pack.

Please feel free to share with team mates and friends.

Enjoy and Keep Smiling,

ROSSI

A Real Estate Broker With Northside Realty in Raleigh, NC